Basically, financial markets are created to bring traders, investors (individuals and legal entities) together, for flowing capital. On a smaller scale, for example, Amazon has provided the same structure for buying and selling products, which is in fact an environment for communication between buyers and sellers, and as we know, it has a great variety of products.

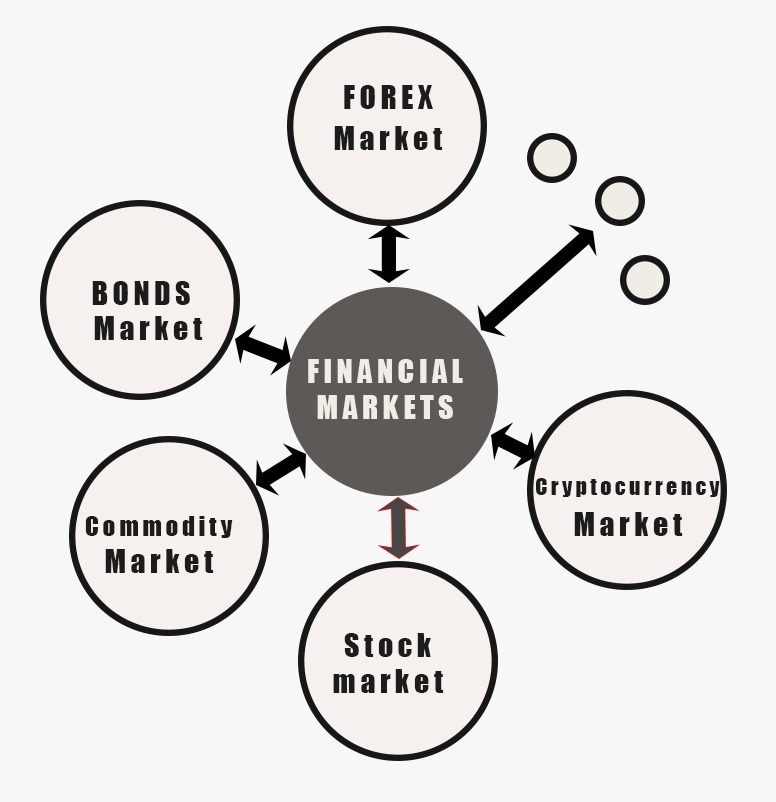

With this structure, there are several financial markets in which investors invest and trade depending on the circumstances.

There are now several financial markets, including the Forex market, Bond markets, Stock markets, Derivatives markets, Commodity markets, and so on.

Note: Financial markets are the basis of the economy of any country or group of countries. The strength or weakness of these markets causes the strength and weakness of the economy of that country, as a result of which, economic parameters such as Unemployment rate, Inflation, interest rates, etc. are affected.

One of the most important characteristics of financial markets is in attracting capital for companies, organizations and …. In fact, these markets allow the exchange of financial assets.

One of the most famous and important financial markets is the stock market. In the stock market, companies offer their securities and individuals or companies become shareholders by buying these securities (factories, banks, etc.). In return for this investment, the shareholder can have two types of income:

- Change in the price of purchased securities over time (profit or loss)

- Receiving profit from the performance of that collection

On the other hand, by receiving capital, that group will be able to grow and expand and will try to improve and develop itself.

The stock market is just one example of the different types of financial markets. In the continuation of this article, we will introduce some financial markets.

financial markets

Introducing financial markets

There are many financial markets today and they are growing dramatically without compliments. For example, perhaps until less than a few years ago, no one had a sign in the cryptocurrency financial markets. But now they are known as one of the most widespread financial markets in the world.

Stock markets:

Stocks and equities are one of the oldest financial markets in the world. The world’s first stock market was established in the 17th century in Amsterdam, the Netherlands. The attractiveness of this market was such that today most of the countries in the world have this type of market.

Before explaining the stock market in more detail, let us clarify what stocks are.

Securities are stocks that represent the claim of ownership on all or part of an asset (such as a company, bank, etc.). This claim applies to all sub-items of that company, such as revenues, real estate, etc.

According to the above description, the stock market is a market in which the shares of different companies are exchanged. This market is one of the main elements of any economy. It is itself a very important factor in moving the economic cycle.

There are different stock markets around the world. These markets are both physical and virtual or a combination of both. The New York Stock Exchange (NYSE) on Wall Street is one of the most famous stock markets in the world, which has a physical location but also trades virtually.

In contrast, the Nasdaq stock market is also a very large stock market that trades virtually.

Commodity markets:

Commodity market is a place where producers and consumers of goods are present to exchange products. In these markets, commodities are in different categories such as agricultural products (cotton, wheat, soybeans, etc.), metals (gold, Silver, copper, etc.) goods such as (cotton, linen, sugar, etc.) and energy categories (oil, gas, etc.) are bought and sold. The philosophy of these markets is to eliminate the negative points in traditional markets such as price fluctuations, fraud, etc. by creating a regulatory mechanism.

There are basically two groups of traders in the commodity markets

- Those who use goods. This market allows them to be safe from market fluctuations.

- Traders who take advantage of fluctuations.

Today, commodity markets are one of the most important components of any economy and exist in most countries of the world. The most famous of these markets are the Chicago Commodity Market, which is more than 170 years old (CME), the London Metal Exchange (LME), the New York Stock Exchange (NYMEX), and the Tokyo Commodity Exchange (TOCOM).

Forex market:

The Forex market is the largest financial market in the world, with several thousand billion dollars traded daily. The simplest definition of this market is the conversion of one currency into another. Sharing currencies with each other is common in the world.

This market is decentralized and does not have a specific point in the world. The most important operators of this market (banks (including central banks, large banks, etc.), large financial institutions, traders, export and import companies, etc. Almost all currencies are traded in this market, but the main currencies are the US Dollar, the Australian Dollar, the New Zealand Dollar, the Canadian Dollar, the British Pound, the Japanese Yen and the Swiss Franc. You want convert US dollar to Euros for any reason, the conversion rate is not fixed and you will receive more or less Euros depending on the situation. Forex traders earn money from this difference.

Cryptocurrency Currency market:

Cryptocurrency Currency market are emerging markets that have emerged in recent years. The technology of these currencies is basically based on Blockchain technology. Currencies such as Bitcoin, ETHERIUM, etc. are from of this group. One of the characteristics of most of these cryptocurrencies is that they are decentralized. In recent years, the number of cryptocurrencies has increased dramatically. Currencies and the demand for their exchange led to the creation of exchange offices of this currency code and traded them with different currencies such as the dollar.

In addition to the markets mentioned here, there are many financial markets such as money markets, derivatives markets, and so on. In other words, wherever there is a discussion of trading in different ways, there is a reciprocal market.